Budgeting doesn't work for families. Systems do.

Build your family's financial machine to save, invest, and plan for retirement.

Using your real numbers.

Is this right for you?

You just never had a system

that fits your life.

You've read the books. Listened to the podcasts. Maybe even tried a budgeting app.

And still, you're wondering:

Am I saving enough? Should I be investing more? Am I on track?

Everyday I see the same problems:

- Most financial advice is built for high earners

- Generic tips don't fit your specific situation

- Budgeting apps track spending but don't build wealth

- Every influencer says something different

Imagine knowing exactly

where your money should go

This isn’t about becoming a finance expert. It’s about finally having a plan that fits your family. That’s why I’ve created:

A simple, step-by-step system to save, invest, and plan for retirement.

Financial Pinwheel isn't another generic course that tells you to "spend less than you earn."

It's a complete system designed for families who are stable but stuck. Who want clarity, not complexity. Who need a plan that works for their actual life, not some theoretical budget for someone else's situation.

How it works:

The result?

A personalized financial plan built on your numbers. Tools and templates you'll use for years, and the confidence to make decisions without second-guessing yourself.

Everything you need to build your

family's financial plan

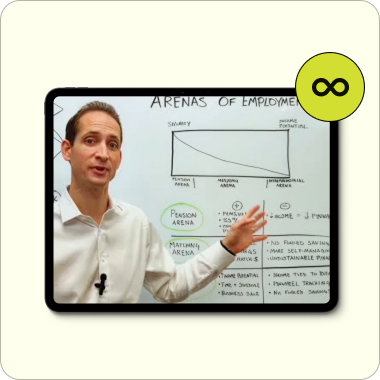

Step-by-Step Video Course

8 modules with 30 bite-size video lessons that walk you through the entire system. Watch at your own pace. Pause. Rewind. Come back whenever you need.

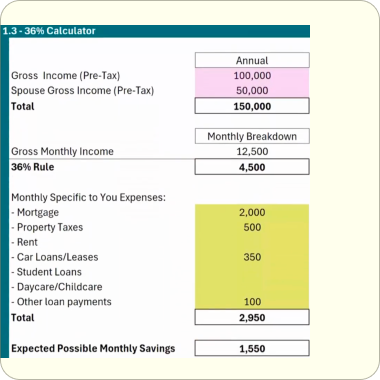

Plug-In-Your-Numbers Calculators

These aren't generic spreadsheets. Input YOUR income, YOUR expenses, YOUR goals and see YOUR plan come to life. Lifestyle expenses, savings rate, income growth, and more.

The Financial Pinwheel E-Book

The companion guide that reinforces everything you learn. Keep it as a reference long after you finish the course.

Knowledge Checks Throughout

Built-in checkpoints to confirm you're understanding the material before moving on. No more “I watched it but forgot everything.”

Lifetime Access

This isn’t a subscription. Buy once, access forever. Come back whenever life changes and you need to update your plan.

Hi, I'm Joseph Okaly.

Over 15 years I worked my way from intern to CFP® Financial Adviser to firm owner before turning 40. I've helped countless families retire. It's the only career I've ever known.

But here's what I kept noticing:

Most financial education falls into two camps. Either it's crisis mode, “you're drowning in debt, let me save you,” or it's wealth optimization, “here's how to maximize your portfolio when you already have money.”

What about everyone in the middle?

The families who are doing okay, but feel lost. Who have some savings, but no real plan. Who want to make smart decisions, but don't know where to start.

I grew up in a middle-class family in Northern New Jersey. My mom was a single mother who had to go back to work to support us.

When my mentor created a financial plan for her, I watched her literally dance in his office. The relief. The confidence. The clarity.

That moment changed everything for me.

I want you to feel the same way.

That’s why I created The Financial Pinwheel. Not to turn you into a finance expert, but to give you a simple system that works for your actual life.

My goal is to help 100,000 families just like yours.

- ✅ CFP® (Certified Financial Planner)

- ✅ Firm owner before age 40

- ✅ TEDx Speaker

- ✅ Author of “The Financial Pinwheel”

- ✅ International podcast guest

- ✅ Husband, father, coach, community volunteer

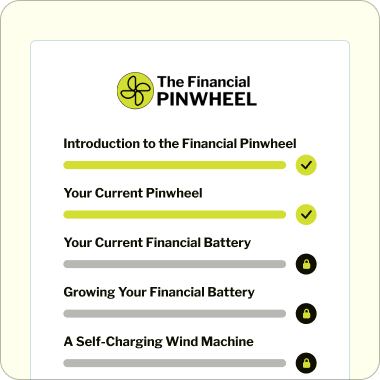

8 interactive modules that build your

complete financial plan

Introduction to the Financial Pinwheel

Understand the system and how it applies to your family's situation.

Your Current Pinwheel

See exactly where you stand — what you save vs what you spend.

Your Current Financial Battery

Assess your savings and investments. Understand the two parts that power your future.

Growing Your Financial Battery

Calculate how much you need to save. Build your strategy to get there.

A Self-Charging Wind Machine

Learn how investments make your money grow on autopilot. The basics of compound growth, in plain English.

Preparing for a Hurricane

Protect what you've built. Insurance and safeguards for your family.

Maintaining Your Pinwheel

Keep your plan updated as life changes. Income grows, kids get older, goals shift.

You'll know how much you spend, how much you save and if you're on track.

You'll see how your money is working for you.

You'll have a plan built for yourself, by yourself, with your own numbers.

Your investment

8 modules, 30 video lessons

8 modules, 30 video lessons Plug-in-your-numbers calculators

Plug-in-your-numbers calculators The Financial Pinwheel e-book

The Financial Pinwheel e-book Knowledge checks throughout

Knowledge checks throughout Lifetime access

Lifetime access

30-Day Money-Back Guarantee

Try the entire course. Work through the calculators. Build your plan.

If within 30 days you don’t feel more confident and clear about your family’s finances,

just let us know. Full refund. No questions. No hassle.

The only risk is staying stuck.